Indoor Digital Signage Solutions for Financial Institutions.In today's fast-paced digital world, financial institutions are constantly seeking innovative ways to enhance customer experience, streamline operations, and communicate effectively. One technology that has gained significant traction in this regard is indoor digital signage. By leveraging dynamic, interactive displays, financial institutions can revolutionize the way they engage with their clients, provide crucial information, and promote their services. This article explores the myriad benefits and applications of indoor digital signage solutions tailored specifically for the financial sector.

Introduction

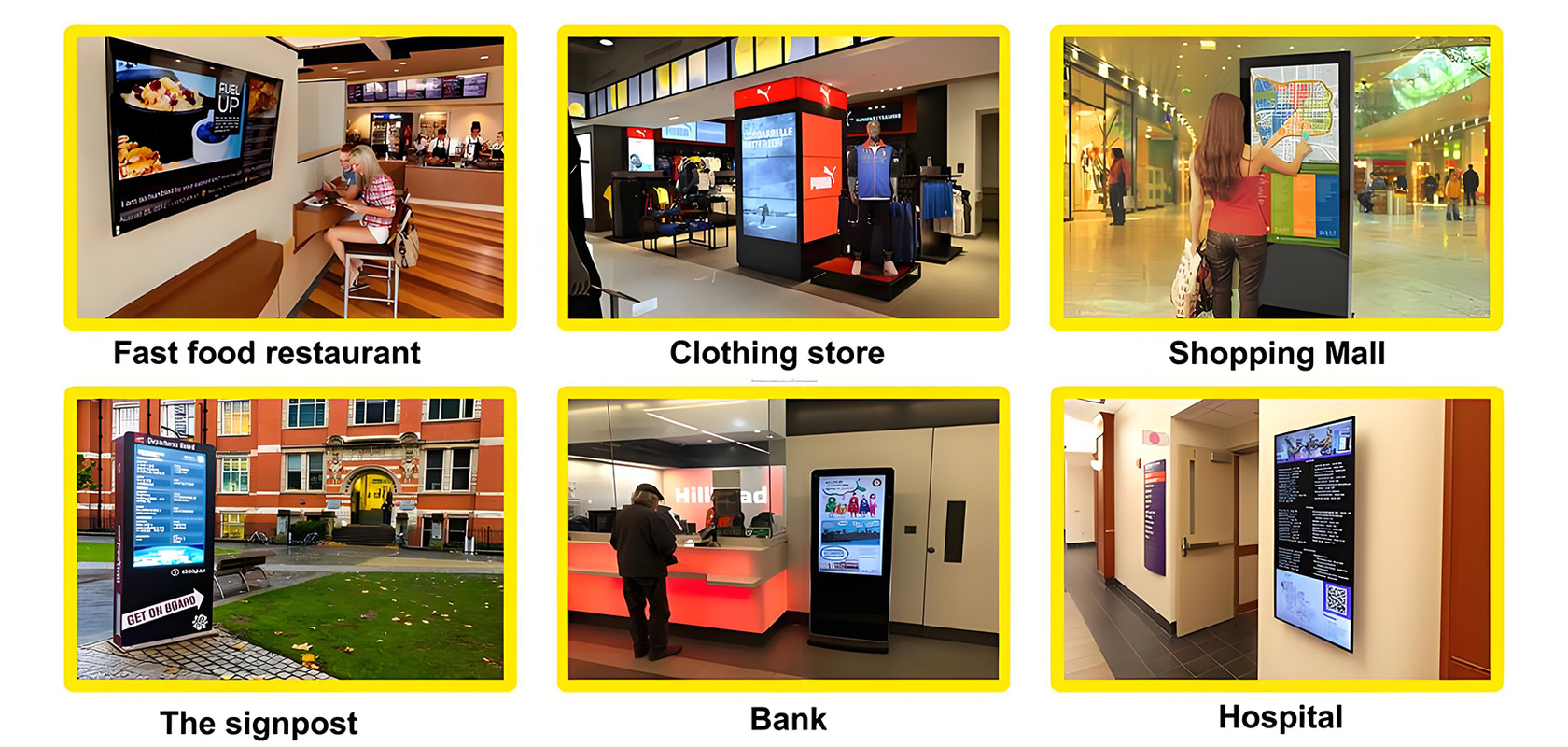

Indoor digital signage refers to the use of electronic displays, such as LCD, LED, and projection screens, to convey information and messages within a confined space like a bank, credit union, or financial office. These displays can be standalone kiosks, integrated into wall-mounted systems, or even incorporated into existing architectural elements. The versatility and flexibility of digital signage make it an ideal solution for financial institutions aiming to modernize their communication strategies.

Enhancing Customer Experience

One of the primary advantages of indoor digital signage in financial institutions is its ability to significantly enhance the customer experience. Traditional static signs and posters are often overlooked or fail to capture the attention of visitors. In contrast, digital displays can be eye-catching, engaging, and highly informative.

Interactive Kiosks

Interactive kiosks, for instance, can provide customers with instant access to account information, transaction histories, and even loan applications. These self-service terminals reduce wait times and empower customers to manage their finances independently. By integrating touch-screen technology, financial institutions can create an intuitive user interface that guides customers through various services with ease.

Moreover, interactive kiosks can offer personalized recommendations based on the customer's financial behavior and history. For example, if a customer frequently inquires about savings accounts, the kiosk can suggest the best savings options tailored to their needs. This level of personalization not only enhances the customer experience but also fosters a deeper connection between the institution and its clients.

Dynamic Wayfinding

Navigating through a large financial institution can be daunting, especially for first-time visitors. Digital signage can solve this problem by providing dynamic wayfinding solutions. By installing interactive maps and directional signs, financial institutions can guide customers to the right departments, ATMs, or meeting rooms effortlessly. These systems can also update in real-time, reflecting any changes in the layout or services offered.

Streamlining Operations

Beyond enhancing customer experience, indoor digital signage also streamlines internal operations within financial institutions. By automating routine tasks and providing real-time updates, digital displays help staff members work more efficiently.

Employee Communication

Internal digital signage can serve as a powerful tool for employee communication. Instead of relying on printed memos or emails, financial institutions can use digital displays to broadcast important messages, updates, and announcements instantly. This ensures that all staff members are always informed and up-to-date, regardless of their location within the building.

For instance, if there's a sudden change in interest rates or a new policy implementation, digital signs can immediately relay this information to all employees. This eliminates the need for time-consuming meetings or printed materials, allowing staff to focus on their core responsibilities.

Queue Management

Another operational benefit of digital signage is its ability to manage queues effectively. By displaying real-time wait times and service statuses, financial institutions can inform customers about the expected wait duration and direct them to the least congested counters or service areas. This not only reduces frustration but also improves the overall flow of customers within the institution.

Furthermore, digital queue management systems can integrate with appointment scheduling software, ensuring that customers with prior appointments are given priority. This helps maintain a balanced workload for staff members and minimizes waiting times for scheduled customers.

Promoting Services and Products

Indoor digital signage offers an excellent platform for promoting financial products and services. Unlike traditional advertising methods, digital displays can showcase vibrant visuals, animations, and videos to capture the attention of visitors.

Targeted Marketing

Financial institutions can use digital signage to target specific customer segments with tailored marketing messages. For example, displays in the loan department can highlight various loan options, interest rates, and eligibility criteria. Similarly, screens in the investment section can showcase the benefits of different investment vehicles and strategies.

By analyzing customer data, financial institutions can further personalize these marketing messages. For instance, if a customer frequently visits the savings account section, the digital display can showcase exclusive savings offers or promotions. This targeted approach not only increases the effectiveness of marketing campaigns but also enhances the relevance of the information presented to customers.

Cross-Selling Opportunities

Digital signage also presents cross-selling opportunities by promoting complementary services. For example, while a customer is waiting to speak with a loan officer, a nearby display can highlight the benefits of opening a savings account or applying for a credit card. By strategically placing these promotions, financial institutions can increase the adoption of multiple services per customer, thereby boosting overall revenue.

Real-Time Information Dissemination

In the financial sector, timely information is crucial. Digital signage enables financial institutions to disseminate real-time information effectively, keeping customers and staff informed about market updates, news, and emergencies.

Market Updates

Financial institutions can use digital displays to show real-time stock market updates, currency exchange rates, and other financial indicators. This information is particularly valuable in investment banks or financial advisory firms where customers expect to stay informed about market trends and fluctuations.

By providing this information in a visually appealing format, financial institutions can position themselves as knowledgeable and reliable sources of financial news. This, in turn, fosters trust and loyalty among customers.

Emergency Alerts

In the event of an emergency, such as a natural disaster or a security threat, digital signage can be used to quickly disseminate critical information. Displays can show emergency exit routes, safety instructions, or updates on the situation. This ensures that both customers and staff are well-informed and can take appropriate action promptly.

Conclusion

Indoor digital signage solutions offer a multitude of benefits for financial institutions, ranging from enhanced customer experience to streamlined operations and effective marketing. By leveraging this technology, financial institutions can create a modern, dynamic environment that meets the evolving needs of their customers and staff.

Whether it's through interactive kiosks, dynamic wayfinding, employee communication, queue management, targeted marketing, or real-time information dissemination, digital signage has the potential to transform the way financial institutions operate. As this technology continues to evolve, financial institutions that embrace it will undoubtedly stay ahead of the curve, providing exceptional service and fostering stronger relationships with their clients.

In summary, indoor digital signage is not just a technological advancement; it's a strategic investment that can significantly impact the efficiency, effectiveness, and profitability of financial institutions. By integrating digital displays into their communication and operational strategies, financial institutions can create a future-forward environment that sets them apart in today's competitive market.

Current article link: https://www.lcdkiosk.com/news/819.html

Tel