Digital Signage for Banks: Modernizing Customer Communication

Digital Signage for Banks: Modernizing Customer Communication.In today's rapidly evolving financial landscape, banks are continuously seeking innovative ways to enhance customer experience and streamline operations. Among the myriad of technological advancements, digital signage stands out as a versatile and impactful tool that can significantly transform the way banks communicate with their customers. By leveraging dynamic, interactive displays, banks can not only modernize their branch environments but also foster a more engaging, informative, and personalized experience for visitors.

The Evolution of Banking Communication

Traditional banking has often been synonymous with static, paper-based communication—posters, brochures, and pamphlets adorning walls and countertops. While these materials have served their purpose, they fall short in today's digital age where customers expect immediacy, personalization, and interactivity. The advent of digital signage marks a significant shift in how banks can deliver information, services, and promotions.

Digital signage refers to electronic displays that present information, advertising, or other content in a dynamic and interactive format. These displays can range from simple LCD screens to sophisticated touch-enabled kiosks, allowing banks to tailor their messaging to the specific needs and preferences of their customers. As banks strive to create a more seamless and intuitive customer journey, digital signage emerges as a cornerstone of modern communication strategy.

Enhancing the In-Branch Experience

Upon entering a bank, customers are immediately greeted by the ambiance and the information presented within. Digital signage can play a pivotal role in setting the tone and providing value from the moment customers step inside. Here's how:

1. Welcome Screens and Brand Messaging

Digital welcome screens can display a warm greeting along with the bank's logo, tagline, and other branding elements. These screens can be updated in real-time to reflect seasonal promotions, special offers, or important announcements. By doing so, banks can reinforce their brand identity and create a cohesive, professional impression from the outset.

Moreover, these screens can showcase the bank's commitment to security and customer service. Messages about the latest security measures, customer support channels, and digital banking services can be rotated to keep customers informed and reassured.

2. Queue Management and Wait Times

Long wait times are a common pain point in banking. Digital signage can help manage customer expectations by displaying real-time queue information and estimated wait times. This transparency fosters a sense of fairness and control, reducing frustration and improving overall satisfaction.

Interactive kiosks can further alleviate wait times by offering self-service options such as account balance checks, fund transfers, and bill payments. Customers can perform these quick transactions while waiting, making their visit more efficient and productive.

3. Promoting Financial Education

Banks have a unique opportunity to educate their customers on financial literacy and responsible banking practices. Digital signage can be used to display tips on budgeting, saving, investing, and fraud prevention. These educational messages can be presented in an engaging, easy-to-understand format, empowering customers to make informed financial decisions.

By positioning themselves as trusted advisors, banks can strengthen their relationship with customers and differentiate themselves from competitors. Financial education through digital signage also aligns with regulatory requirements for customer protection and informed consent.

4. Personalized Messaging and Offers

Digital signage can be integrated with customer relationship management (CRM) systems to deliver personalized messaging and offers based on individual customer profiles. For example, a screen might display a targeted loan promotion to a customer who recently inquired about financing options or highlight a savings account to someone who frequently makes deposits.

This level of personalization not only enhances the relevance of the messaging but also demonstrates that the bank values and understands its customers' needs. It encourages loyalty and deepens the customer-bank relationship by showing that the bank is attentive and responsive to individual preferences.

5. Interactive Services and Support

Beyond traditional transactions, digital signage can offer a range of interactive services that enhance the customer experience. Touch-screen kiosks can provide detailed product information, help customers compare different financial products, and even facilitate appointments with bank representatives.

For customers with specific needs, such as those seeking mortgage advice or investment guidance, interactive displays can offer a preliminary assessment or questionnaire. This information can then be used to tailor the subsequent conversation with a bank advisor, making the consultation more efficient and personalized.

Streamlining Operations and Improving Efficiency

Digital signage isn't just a customer-facing tool; it also offers significant benefits for bank employees. By automating routine tasks and providing real-time information, digital displays can streamline operations and enhance productivity.

1. Employee Training and Development

Internal digital signage can be used to deliver training materials, updates on policies and procedures, and performance metrics to staff. This ensures that employees are always up-to-date with the latest information and equipped to provide the best possible service to customers.

Moreover, digital signage can facilitate continuous learning by displaying educational content during downtime or breaks. This ongoing training can improve employee knowledge and skills, ultimately leading to better customer service.

2. Real-Time Information and Collaboration

In a fast-paced banking environment, access to real-time information is crucial. Digital signage can display up-to-the-minute data on market trends, interest rates, and customer activity. This enables employees to make informed decisions quickly and respond to customer inquiries more effectively.

Collaborative tools integrated into digital signage can also facilitate communication between different departments and branches. For example, a screen might display a live feed of customer interactions at another branch, allowing staff to coordinate responses and share best practices.

3. Remote Management and Control

Digital signage systems can be remotely managed and controlled, enabling banks to update content, monitor performance, and troubleshoot issues from a central location. This centralized control reduces the need for on-site maintenance and ensures that all displays are consistently delivering the intended messaging.

Remote management also allows for greater flexibility in scheduling content. Banks can adjust the display schedule to align with peak customer times, ensuring that important messages are seen by the right audience at the right time.

The Future of Banking Communication

As technology continues to evolve, so too will the role of digital signage in banking. Advancements in artificial intelligence, machine learning, and data analytics will enable even more personalized and responsive communication. For example, facial recognition technology could be used to identify customers and display tailored messaging based on their previous interactions and preferences.

Furthermore, the integration of digital signage with mobile banking apps and other digital channels will create a seamless, omnichannel experience. Customers will be able to transition smoothly between online and in-branch services, enjoying a consistent, high-quality experience regardless of the touchpoint.

In conclusion, digital signage offers banks a powerful way to modernize customer communication and enhance the in-branch experience. By leveraging dynamic, interactive displays, banks can deliver personalized messaging, streamline operations, and foster a more engaging and informative environment. As technology continues to advance, digital signage will play an increasingly central role in the future of banking, helping banks stay ahead of customer expectations and drive long-term loyalty.

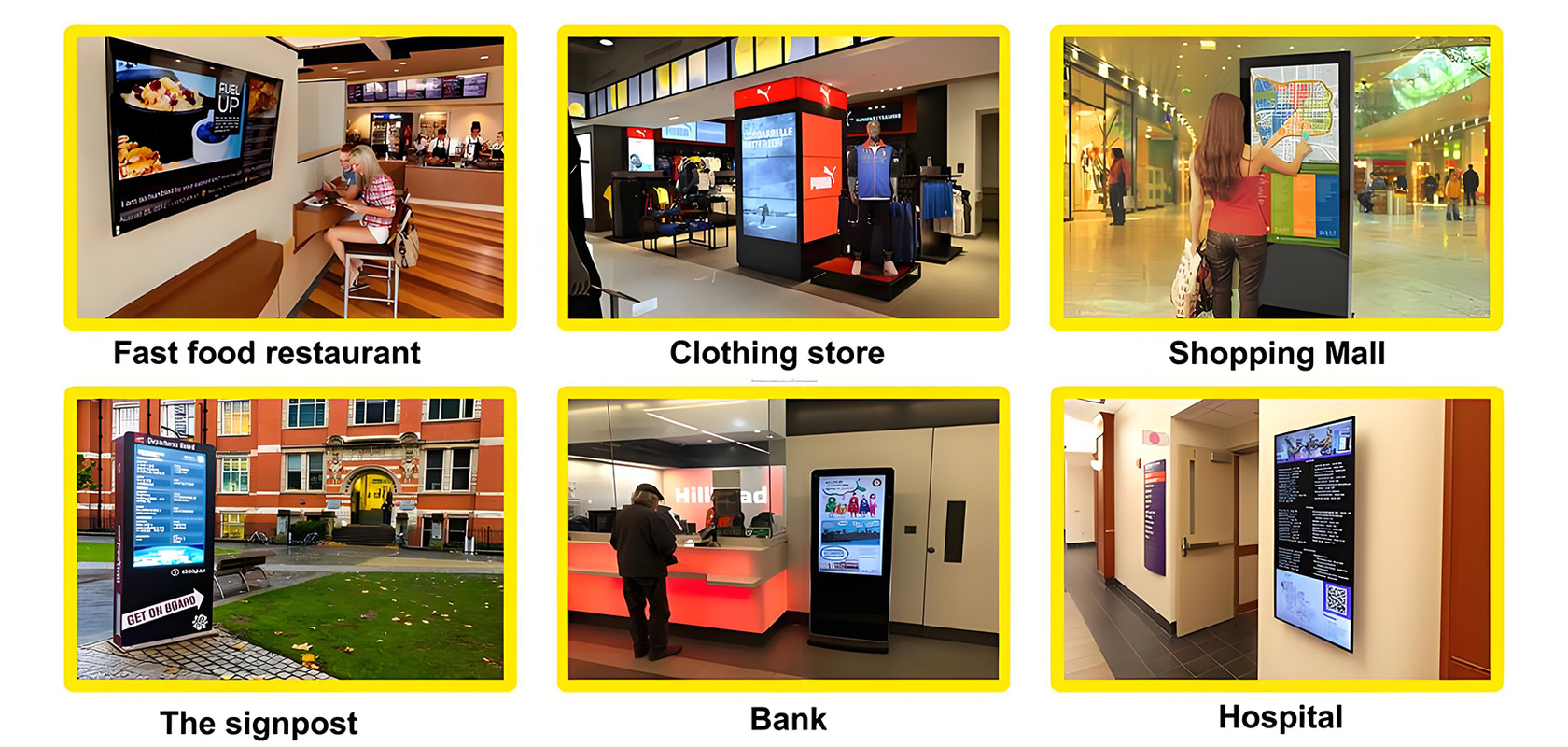

Application scenarios of digital signage