Digital Signage for Banks: Enhancing Customer Interactions

Digital Signage for Banks: Enhancing Customer Interactions.In today's rapidly evolving digital landscape, banks are continuously seeking innovative ways to enhance customer experiences and streamline operations. One technology that has gained significant traction in this regard is digital signage. Digital signage for banks leverages cutting-edge display technologies, real-time data integration, and interactive elements to revolutionize how banks communicate with their customers. This article explores the various facets of digital signage in banking, highlighting its benefits, applications, and the transformative impact it has on customer interactions.

Introduction

Digital signage refers to the use of electronic displays to show information, advertising, and other content. In the banking sector, these displays can range from simple screens providing account information to sophisticated interactive kiosks offering a variety of self-service options. The primary objective of digital signage in banks is to improve customer engagement, streamline service delivery, and enhance the overall banking experience.

The Evolution of Banking and Digital Signage

Traditional banking relied heavily on printed materials and face-to-face interactions. However, with the advent of digital technology, banks have been able to automate many processes and provide customers with 24/7 access to services through online banking and mobile apps. Digital signage represents the next step in this evolution, bridging the gap between the physical and digital banking environments.

Early Adoption

The adoption of digital signage in banks started with basic information displays, such as interest rates, exchange rates, and promotional messages. Over time, these displays have become more sophisticated, incorporating real-time data feeds, interactive touchscreens, and even artificial intelligence (AI) to deliver personalized experiences.

Current Trends

Today, digital signage in banks is all about creating immersive, interactive experiences. Customers expect more than just static information; they want engaging content, self-service options, and seamless integration with their digital banking tools. This has led to the development of smart branches, where digital signage plays a central role in driving customer engagement and satisfaction.

Benefits of Digital Signage for Banks

Digital signage offers a multitude of benefits for banks, ranging from improved customer experiences to enhanced operational efficiency.

Enhanced Customer Engagement

Interactive digital displays can captivate customers with dynamic content, such as videos, animations, and real-time data. This not only makes the waiting experience more enjoyable but also provides an opportunity for banks to cross-sell and upsell their products and services.

Improved Communication

Digital signage enables banks to communicate important messages, such as changes in policies, new product launches, and promotional offers, in a timely and effective manner. This ensures that customers are always informed and up-to-date with the latest banking information.

Real-Time Data Integration

By integrating with core banking systems, digital signage can display real-time account information, transaction history, and other relevant data. This empowers customers to make informed decisions and stay in control of their finances.

Streamlined Operations

Self-service kiosks and interactive displays can automate routine transactions, such as account balance checks, fund transfers, and bill payments. This reduces the workload on bank staff, allowing them to focus on more complex tasks and providing better customer service.

Personalized Experiences

Using AI and machine learning, digital signage can analyze customer data to deliver personalized content and recommendations. For example, a display might show a customer personalized investment advice based on their financial history and risk appetite.

Enhanced Brand Image

Digital signage can help banks project a modern, tech-savvy image, which is crucial in attracting and retaining tech-savvy customers. A well-designed digital signage system can create a lasting impression and reinforce the bank's brand identity.

Applications of Digital Signage in Banks

Digital signage can be used in various ways within a bank to enhance customer interactions and improve operational efficiency.

Welcome Screens

Digital welcome screens can greet customers as they enter the branch, providing them with a warm and engaging start to their banking experience. These screens can display personalized messages, such as account balances, recent transactions, and appointment reminders.

Self-Service Kiosks

Self-service kiosks allow customers to perform a variety of transactions without the need for assistance from bank staff. These kiosks can be used for account inquiries, fund transfers, bill payments, and even opening new accounts.

Queue Management Systems

Digital queue management systems can display wait times and direct customers to the appropriate service counters. This helps reduce wait times and improves the overall flow of customers within the branch.

Promotional Displays

Digital displays can be used to promote the bank's products and services, such as loans, credit cards, and investment opportunities. These displays can be strategically placed within the branch to maximize visibility and engagement.

Educational Content

Digital signage can also be used to educate customers on financial literacy, investment strategies, and other relevant topics. This not only helps customers make informed decisions but also positions the bank as a trusted financial advisor.

Virtual Tellers

Some banks are now using virtual tellers, which are AI-powered chatbots that can assist customers with their banking needs through a digital display. These virtual tellers can handle basic inquiries, provide product information, and even facilitate transactions.

Implementing Digital Signage in Banks

Implementing a digital signage system in a bank requires careful planning and execution. Here are some key steps to ensure a successful deployment:

Needs Assessment

Start by assessing the bank's specific needs and objectives for digital signage. Identify the key areas where digital signage can add value, such as customer engagement, self-service, and promotional displays.

Content Strategy

Develop a content strategy that aligns with the bank's brand identity and target audience. This should include a mix of static and dynamic content, such as videos, animations, and real-time data feeds.

Technology Selection

Choose the right hardware and software for the digital signage system. This includes displays, media players, content management systems, and any necessary integrations with core banking systems.

Installation and Configuration

Work with a professional digital signage provider to install and configure the system. Ensure that the displays are strategically placed within the branch for maximum visibility and engagement.

Training and Support

Provide training for bank staff on how to use and maintain the digital signage system. Establish a support plan to address any issues or questions that may arise.

Monitoring and Optimization

Continuously monitor the performance of the digital signage system and make adjustments as needed. Use analytics to track engagement levels, content effectiveness, and system performance.

Conclusion

Digital signage has become an indispensable tool for banks looking to enhance customer interactions and improve operational efficiency. By leveraging cutting-edge display technologies, real-time data integration, and interactive elements, banks can create immersive, engaging experiences that meet the evolving needs of their customers. Whether used for self-service, promotional displays, or educational content, digital signage has the potential to transform the banking experience and reinforce the bank's brand identity.

As technology continues to advance, the possibilities for digital signage in banks will only grow. By staying at the forefront of these developments, banks can ensure that they remain competitive in the ever-changing financial landscape and provide their customers with the best possible banking experience.

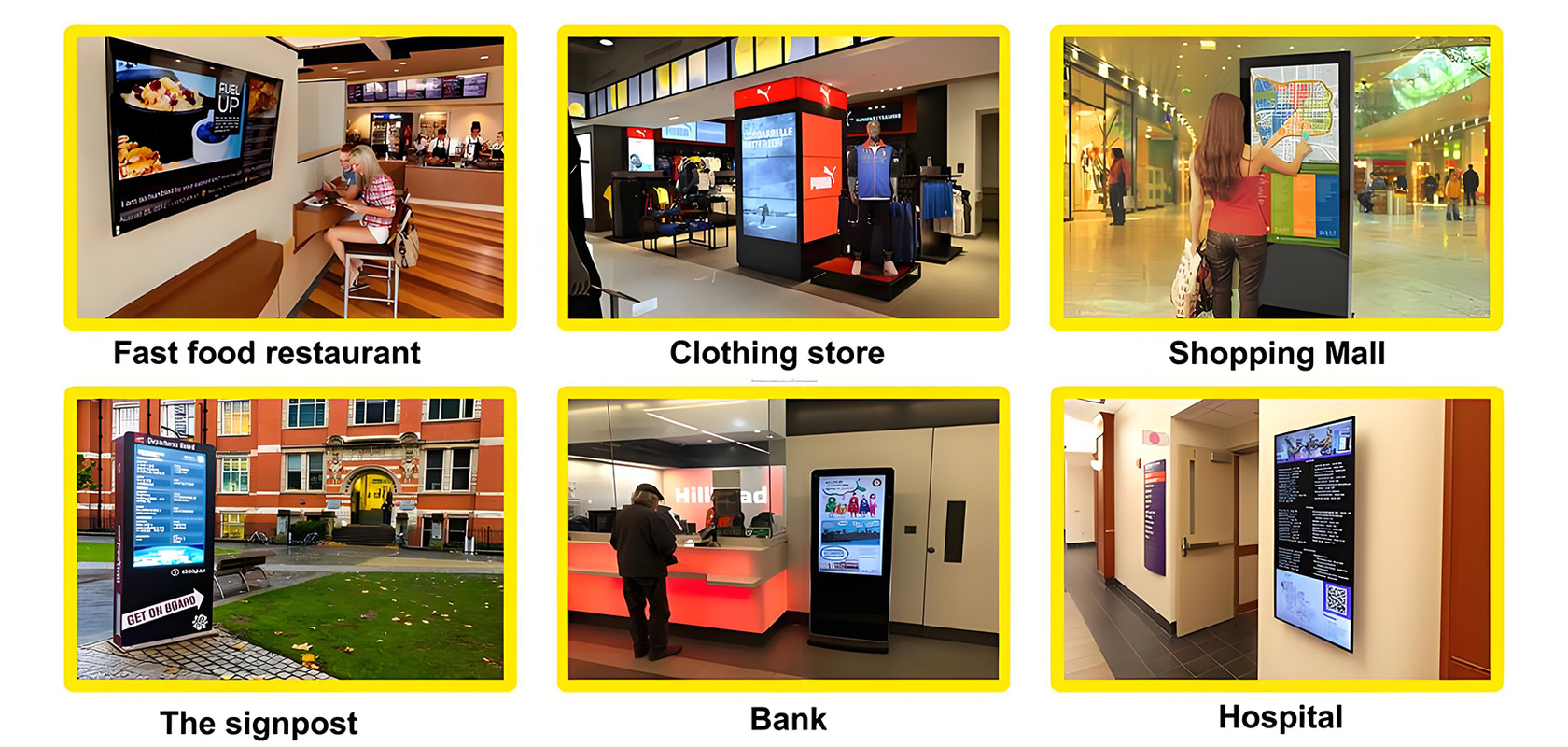

Application scenarios of digital signage