Digital Signage for Financial Institutions: Enhancing Customer Service.In the rapidly evolving landscape of financial services, financial institutions are continually seeking innovative ways to enhance customer experiences, streamline operations, and communicate effectively. One technology that has emerged as a powerful tool in achieving these objectives is digital signage. By leveraging digital displays, financial institutions can improve customer service, deliver targeted messaging, and create a modern, engaging environment. This article explores the various ways digital signage can be utilized in financial institutions to enhance customer service and overall efficiency.

Introduction to Digital Signage

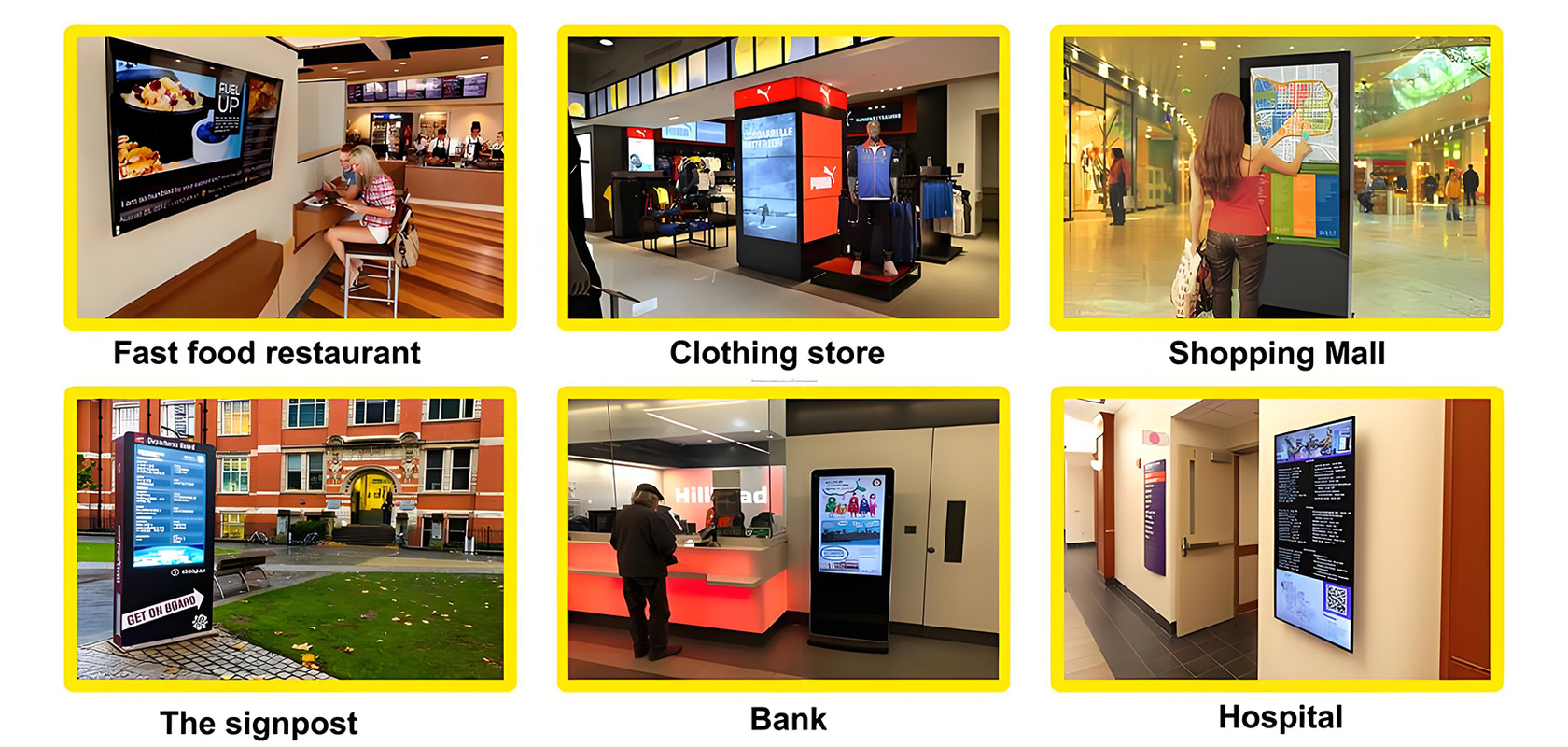

Digital signage refers to the use of electronic displays, such as LCD, LED, and projection screens, to present information, advertising, and other content. These displays can be found in a variety of settings, including retail stores, restaurants, corporate offices, and, increasingly, financial institutions. Unlike traditional static signs, digital signage allows for dynamic content that can be updated in real-time, enabling institutions to deliver timely and relevant information to their customers.

The Benefits of Digital Signage for Financial Institutions

Improved Customer Communication

Digital signage offers financial institutions a dynamic platform to communicate with customers. Whether it's displaying up-to-date financial news, promoting new products and services, or providing important notifications about branch operations, digital signs can deliver information quickly and effectively. This real-time communication helps keep customers informed and engaged, enhancing their overall experience.

Enhanced Customer Experience

In today's digital age, customers expect a seamless and engaging experience when they visit a financial institution. Digital signage can contribute to this by offering interactive features such as touchscreens that provide account information, loan calculators, and investment advice. These interactive elements empower customers to access the information they need quickly and conveniently, reducing wait times and improving satisfaction.

Streamlined Operations

Digital signage can also streamline internal operations by providing employees with real-time access to critical information. For example, displays can show up-to-the-minute account statuses, transaction details, and customer appointment schedules. This enables staff to respond more efficiently to customer needs, reducing errors and improving service quality.

Targeted Marketing and Promotions

Financial institutions can use digital signage to target specific customer segments with personalized marketing messages. By analyzing customer data, institutions can tailor promotions and offers to individual preferences, increasing the likelihood of conversion. Additionally, digital signs can be used to cross-sell and upsell products and services, enhancing revenue opportunities.

Brand Reinforcement

Consistent branding across all digital displays helps reinforce the institution's brand identity. High-quality images, videos, and consistent color schemes can create a cohesive and professional appearance, instilling trust and confidence in customers. Digital signage can also be used to showcase the institution's values, mission, and community involvement, further strengthening brand loyalty.

Applications of Digital Signage in Financial Institutions

Welcome Screens and Directory Boards

Digital welcome screens and directory boards can greet visitors and provide important information about branch services, hours of operation, and staff members. Interactive touchscreens can help customers navigate the branch, find the services they need, and even check-in for appointments.

Queue Management

Digital signage can be integrated with queue management systems to display wait times, call numbers, and service alerts. This helps manage customer expectations and reduces perceived wait times, contributing to a more positive customer experience.

Promotional and Educational Content

Financial institutions can use digital displays to promote new products, special offers, and educational content. For example, screens can feature videos explaining complex financial concepts, demonstrating how to use online banking tools, or highlighting the benefits of various investment strategies.

Financial News and Market Updates

Real-time financial news and market updates can keep customers informed about current economic conditions and investment opportunities. This information can be displayed on screens throughout the branch, creating an engaging and informative environment.

Virtual Teller Stations

Some institutions are implementing virtual teller stations, which allow customers to conduct transactions with remote tellers via video conferencing. These stations can be equipped with digital signage to provide instructions, transaction details, and customer support information.

Security and Compliance

Digital signage can be used to display important security and compliance information, such as privacy policies, anti-fraud tips, and regulatory notices. This ensures that customers are aware of and understand the institution's commitment to security and compliance.

Implementing Digital Signage: Best Practices

Content Strategy

Develop a content strategy that aligns with the institution's goals and objectives. Determine what information is most relevant to customers and how it can be presented in an engaging and informative way. Regularly update content to keep it fresh and relevant.

User Experience

Design digital signage with the user in mind. Ensure that content is easy to read and understand, and that navigation is intuitive. Use high-quality images and videos to capture attention and maintain interest.

Consistency

Maintain consistent branding and messaging across all digital displays. This helps reinforce the institution's brand identity and creates a cohesive customer experience.

Integration

Integrate digital signage with other technologies, such as queue management systems, customer relationship management (CRM) software, and online banking platforms. This enables seamless data sharing and enhances the overall functionality of the system.

Analytics

Use analytics to track the performance of digital signage and measure its impact on customer behavior. Collect data on viewership, engagement, and conversion rates to identify areas for improvement and optimize content accordingly.

Security

Ensure that digital signage systems are secure and compliant with relevant regulations. Protect sensitive customer data and maintain system integrity by implementing appropriate security measures, such as encryption, access controls, and regular updates.

Conclusion

Digital signage has become an essential tool for financial institutions seeking to enhance customer service, streamline operations, and communicate effectively. By leveraging the power of digital displays, institutions can improve customer communication, create engaging experiences, and promote their products and services. As technology continues to evolve, digital signage will play an increasingly important role in the financial services industry, helping institutions stay competitive and meet the ever-changing needs of their customers.

Current article link: https://www.lcdkiosk.com/news/304.html

Tel