Digital Signage for Banks & Financial Institutions

In today's fast-paced digital world, financial institutions are constantly seeking innovative ways to improve customer experience, streamline operations, and stay ahead of the competition. One technology that has gained significant traction in this sector is digital signage. By leveraging dynamic, interactive displays, banks and financial institutions can communicate more effectively with their customers, provide real-time information, and create an engaging environment that fosters trust and loyalty. This article explores the benefits and applications of digital signage in the banking and financial industry, highlighting its role in enhancing customer experience and operational efficiency.

The Evolution of Banking Communication

Traditionally, banks and financial institutions relied on static signs, posters, and printed materials to convey information to customers. However, these methods were often limited in their ability to provide timely updates or engage customers in a meaningful way. With the advent of digital signage, financial institutions now have a powerful tool to deliver dynamic content that can be updated instantly, tailored to specific audiences, and integrated with other digital systems.

Digital signage refers to any type of electronic display that shows information, advertising, or other content. These displays can range from simple LCD screens to more advanced interactive kiosks and touchscreens. The versatility and flexibility of digital signage make it an ideal solution for banks and financial institutions that need to communicate complex information in a clear, concise, and visually appealing manner.

Enhancing Customer Experience

One of the primary benefits of digital signage for banks and financial institutions is its ability to enhance the customer experience. By providing real-time information, interactive tools, and personalized content, digital signage can help create a more engaging and informative environment for customers.

Real-Time Information

Digital signage can be used to display real-time information such as interest rates, stock prices, currency exchange rates, and weather updates. This information is not only relevant to customers but also helps to position the financial institution as a trusted source of up-to-date information. Additionally, digital signage can be used to showcase the latest products and services, promotions, and events, ensuring that customers are always aware of what's new and exciting at the bank.

Interactive Tools

Interactive digital signage, such as touchscreens and kiosks, can provide customers with a hands-on experience. These tools can be used to help customers navigate the bank's services, calculate loan payments, or even apply for products online. By offering these self-service options, banks can reduce wait times and improve the overall customer experience.

Personalized Content

Digital signage can also be used to deliver personalized content based on the customer's profile or preferences. For example, a bank could use data analytics to determine a customer's interests and tailor the content displayed on screens accordingly. This level of personalization can help build a stronger connection with customers and increase their satisfaction with the bank's services.

Streamlining Operations

In addition to enhancing the customer experience, digital signage can also help banks and financial institutions streamline their operations. By automating processes, reducing paperwork, and improving communication with employees, digital signage can contribute to increased efficiency and cost savings.

Automating Processes

Digital signage can be integrated with other digital systems, such as online banking platforms, CRM systems, and ATM networks. This integration allows for the automatic updating of content and information, reducing the need for manual updates and ensuring that the information displayed is always accurate. For example, a bank could use digital signage to display real-time account balances or transaction history for customers who log in using their mobile devices.

Reducing Paperwork

By providing customers with self-service options through interactive digital signage, banks can reduce the amount of paperwork required for various transactions. This not only saves time for both customers and employees but also helps to minimize errors and improve the accuracy of information. For instance, customers can use touchscreens to fill out forms or scan documents, which can then be processed digitally.

Improving Employee Communication

Digital signage can also be used to improve communication with employees, particularly in large financial institutions where face-to-face meetings may be infrequent. By displaying important updates, training materials, and performance metrics on digital screens, banks can ensure that employees are always informed and up-to-date. This can lead to increased productivity and a more cohesive work environment.

Applications of Digital Signage in Banking & Financial Institutions

The applications of digital signage in the banking and financial industry are vast and varied. Below are some specific examples of how digital signage can be used in this sector:

Branch Lobby Displays

In the lobby of a bank, digital signage can be used to welcome customers, display promotions, and provide information on the latest products and services. Interactive touchscreens can also be used to help customers find the right product or service for their needs, or to answer frequently asked questions.

Drive-Thru & ATM Screens

Digital signage can be installed at drive-thru and ATM locations to provide customers with real-time information, such as account balances, transaction history, and promotional offers. This can help to enhance the customer experience and reduce wait times.

Meeting & Conference Rooms

In meeting and conference rooms, digital signage can be used to display presentations, financial reports, and other important information. This can help to facilitate more efficient and productive meetings, as well as impress clients and partners with the bank's cutting-edge technology.

Employee Training & Development

Digital signage can also be used for employee training and development. By displaying training materials, performance metrics, and best practices on digital screens, banks can ensure that employees are always informed and up-to-date on the latest industry trends and regulations.

Conclusion

Digital signage has become an invaluable tool for banks and financial institutions seeking to enhance the customer experience and streamline operations. By leveraging dynamic, interactive displays, financial institutions can communicate more effectively with their customers, provide real-time information, and create an engaging environment that fosters trust and loyalty. Additionally, digital signage can help to automate processes, reduce paperwork, and improve communication with employees, contributing to increased efficiency and cost savings.

As the banking and financial industry continues to evolve, digital signage will play an increasingly important role in shaping the future of customer experience and operational efficiency. By embracing this technology, banks and financial institutions can stay ahead of the competition and provide their customers with the high-quality service they expect and deserve.

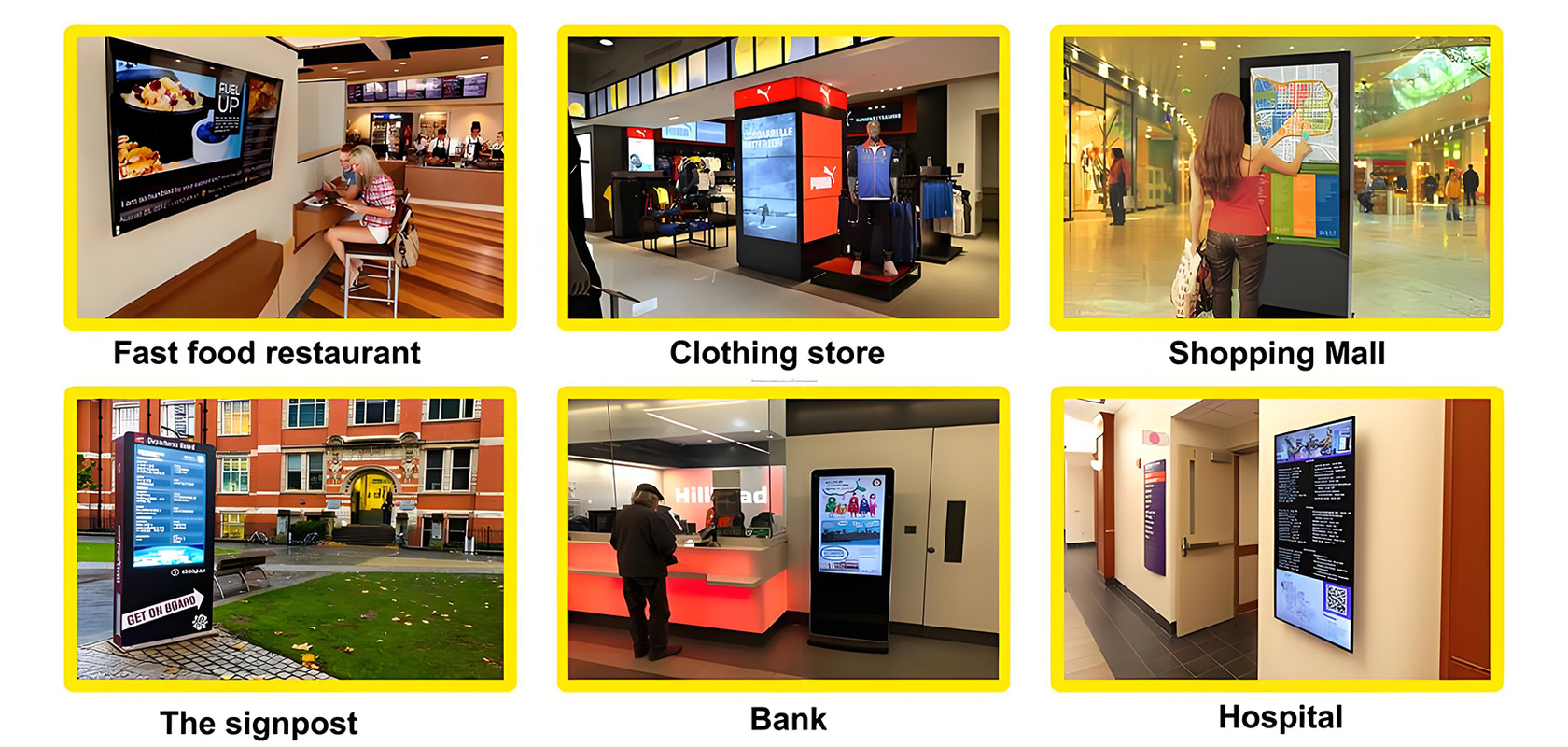

Application scenarios of digital signage